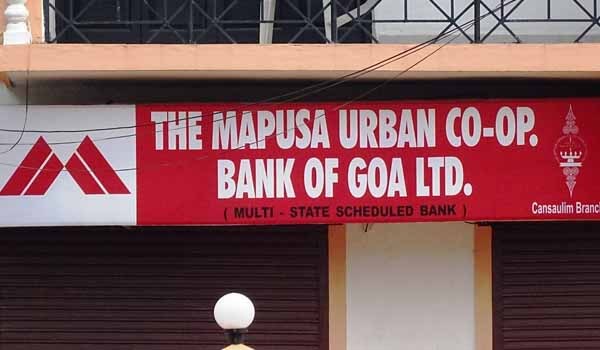

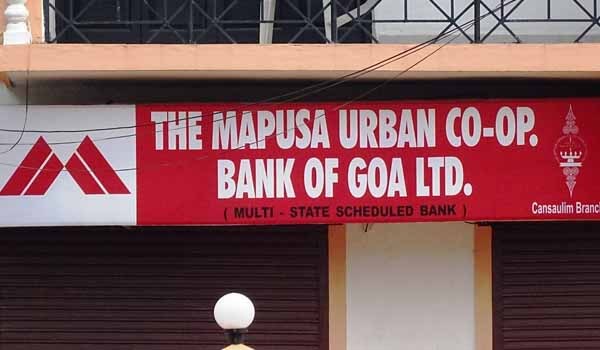

- The Reserve Bank of India (RBI) has canceled the license of The Mapusa Urban Co-operative Bank of Goa Limited, to carry on banking business, with effect from the close of business on 16th April 2020.

- The Reserve Bank canceled the license of the bank as:

i. The bank does not have adequate capital and earning prospects. As such, it does not comply with the provisions of section 11 (1) and section 22 (3) (d) read with section 56 of the Banking Regulation Act, 1949.

ii. The bank has failed to comply with the requirements of section 22(3) (a), 22 (3) (b), 22 (3) (c), 22 (3) (d) and 22 (3) (e) read with section 56 of the Banking Regulation Act, 1949;

iii. The continuance of the bank is prejudicial to the interests of its depositors;

iv. The bank with its present financial position would be unable to pay its present depositors in full, and;

v. The public interest would be adversely affected if the bank is allowed to carry on its banking business any further.

- The Mapusa Urban Co-operative Bank of Goa Ltd., Goa is prohibited from conducting the business of ‘banking’ which includes acceptance of deposits and repayment of deposits as defined in Section 5 (b) read with Section 56 of the Banking Regulation Act, 1949 with immediate effect.

Published On : 17 Apr 2020

Current Affair