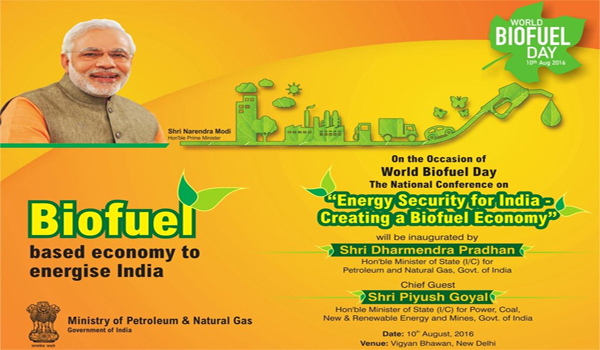

1. World Biofuel Day is observed every year on 10th August to create awareness about the importance of non-fossil fuels as an alternative to conventional fossil fuels and to highlight the various efforts made by the Government in the biofuel sector. The World Biofuel Day is being observed by the Ministry of Petroleum & Natural Gas.

“World Biofuel Day 2018” event was organized in New Delhi today, with the Prime Minister Sh Narendra Modi addressing a diverse gathering, consisting of farmers, scientists, entrepreneurs, students, government officials, and legislators. On the occasion, Sh Narendra Modi unveiled a Booklet on “National Policy on Biofuels 2018”, and launched “Pro-Active and Responsive facilitation by Interactive and Virtuous Environmental Single window Hub” [PARIVESH].

2. Operation “Madad” has been launched by the Southern Naval Command (SNC) at Kochi since 09 Aug 2018 for assisting the state administration and undertaking disaster relief operations due to the unprecedented flooding experienced in many parts of Kerala, owing to incessant rainfall and release of excess water from Idukki and other dams. Based on a request received from Deputy Collector, Wayanad, one diving team with Gemini inflatable boat was airlifted and sent to Kalpetta at 10:00 pm on 09 Aug to undertake rescue operations due to floods and landslides.

3. The President of India, Shri Ram Nath Kovind, inaugurated the ‘One District One Product’ Summit today (August 10, 2018) in Lucknow, Uttar Pradesh.

Speaking on the occasion, the President said that micro, small and medium enterprises are called the backbone of our economy. These enterprises are engines of inclusive development. After the agricultural sector, most people find employment in this sector. This sector generates more employment opportunities at a lower cost of capital. And the most important thing about this sector is that it creates jobs in rural and backward areas.

4. The government has compensated to the States/ UTs for the reported revenue deficit on account of implementation of Goods and Services Tax (GST). As per provisions in Section 7 of the GST (Compensation to States) Act, 2017 loss of revenue to the States on account of implementation of Goods and Services Tax shall be payable during transition period and compensation payable to a State shall be provisionally calculated and released at the end of every two months during transition period of 5 years.